Post Office fixed deposits are regarded as the securest investment alternative for conservative investors in India. By being financed by the Government of India, Post Office FDs come along with safety, yielding options, and predictably matured values. This is where the Post Office FD Calculator becomes useful for the investor in 2026 – to estimate the probable amount of interest income on the principal deposited at the end of the tenure. This way, a fair amount of financial planning not laden with ambiguity can easily be ventured upon.

What Is a Post Office FD Calculator?

The Post Office FD Calculator is an online tool that helps predict the maturity amount and interest income a fixed deposit holder will gain after having kept a deposit for a fixed term. Deposit, tenure, and interest rate applicable; these parameters can be fed into the calculator, which then displays the total return at maturity. This makes the tedious comparison of the tenure viable; investors can decide on the tenure as per their financial goals

Post Office FD Interest Rate for 2026

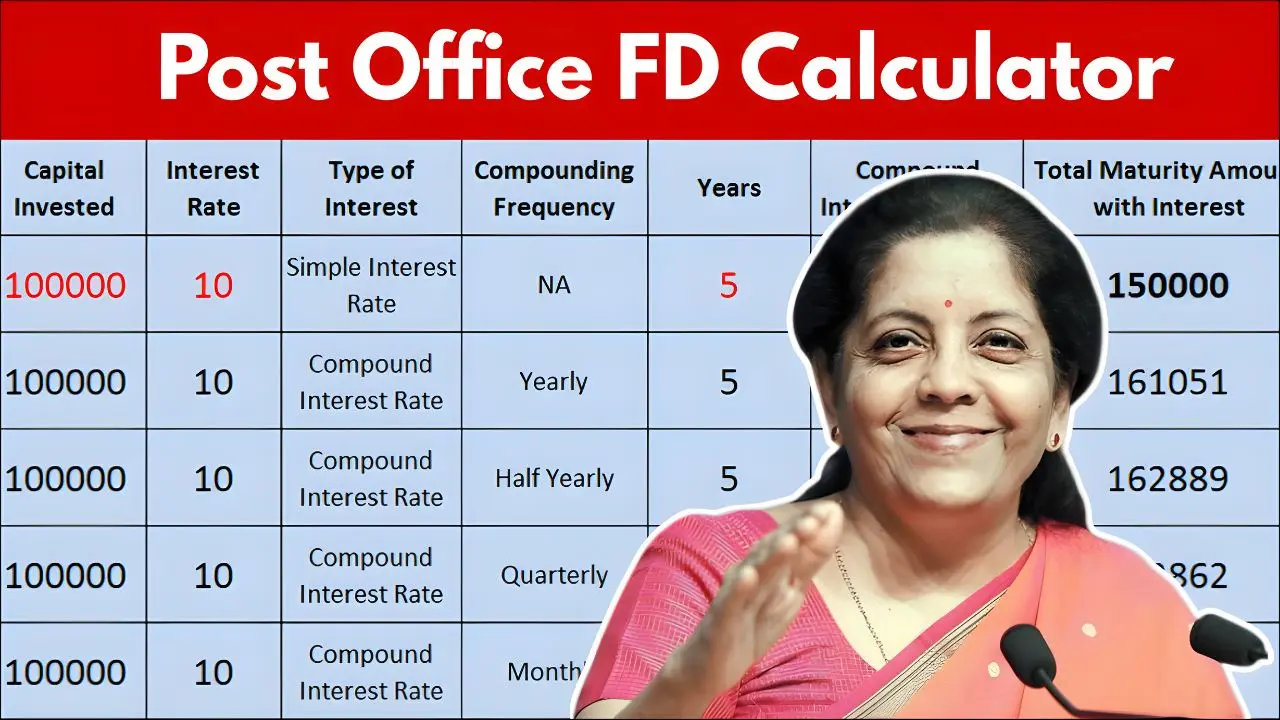

In 2026, Post Office Fixed Deposits appear to provide attractive interest rates versus many bank FDs for those with a mid-term investment state. Interest rates differ with tenure from one to five years. Interest is compounded quarterly while paid yearly, which does provide a better return over a period. How the FD Calculator Works

The calculator takes in the compound interest formula to give compound returns. You enter your deposit amount and the chosen period, and it determines the current interest rate or maturity value. The idea behind developing this tool is to inform the investors about the growth of their investments in numbers, rather than having any manual calculation done or any kind of guesswork.

Perks of Using the Post Office FD Calculator

Calculations, when working manually, can consume a number of boring minutes. Results, although prone to wrong entries, are eventually jeopardizing investments. However, the FD calculator, by the use of depth into time period, in turn comes out with a precise figure, allowing the investor to be better informed on the tenure applicable for the investment, thereby deducting the dates with limited reinvestment strategies awaiting future salary. The calculator becomes a perfectly accurate measuring guide for conservative investors, retirees, and salaried personnel investing in an FD backed by the state governing various post offices.

Who Should Invest in Post Office FD?

Post office FDs are recommended for those on the search for low-risk, stable income. This option commonly pleases public servants, fresh investors, and those with short- to medium-term financial objectives. If differentiated, this scheme does not display any unique interest for the elderly; yet, a safe guarantee gives more signs for older folks to realize that they will get more consistent payments than other retirement schemes.

Post Office FD Taxation in 2026

The interest received on Post Office Fixed Deposits is taxable as per the investor’s income tax slab. However, an exemption can be raked out under Section 80C (of course with five-year period) for long-term tax planning. Investors using the FD calculator should consider the need about taking tax into their calculations. And, also, it hazards wasting the borrower’s net returns on the FD.

Final Remarks

The Post Office FD Calculator 2026 can help investors to make the right decisions. Once you have a rough estimate of the returns you will receive from investing, savings can be really aligned with what you perceive for financial goals. For the extremely risk-averse, investors seeing moderate growth prospects, and a portfolio benefit from the backing of the government, Post Office Fixed Deposits continue to be a good option for 2026.